Every day brings you closer to the long-anticipated retirement dream. However, achieving this dream requires meticulous planning. According to the Employee Benefit Research Institute’s 2022 Retirement Confidence Survey, just 28% of U.S. workers feel very confident about their retirement savings. Clearly, many Americans need to put more effort into their retirement preparations to ensure a comfortable future.

Fortunately, if retirement is still a few years away, there’s ample time to plan effectively. Brentwood, Tennessee, offers numerous resources to help you on this journey.

This blog provides useful advice – from estimating your retirement income needs to seeking guidance from financial professionals – to help you prepare your finances for the upcoming chapter. Use this retirement planning guide, specifically tailored for Brentwood residents, to pave the way for the retirement lifestyle you aspire to achieve.

Retirement Planning in Brentwood, Tennessee

Planning for retirement is an essential step to ensure a comfortable and secure future. For residents of Brentwood, Tennessee, understanding the nuances of retirement planning can make all the difference between a fulfilling retirement and one filled with financial uncertainties. This guide aims to provide Brentwood residents with a comprehensive understanding of retirement planning, covering the basics, its importance, and key factors to consider.

What is Retirement Planning?

Retirement planning involves setting financial and personal goals for your retirement years and developing a plan to achieve them. This process includes estimating your retirement income needs, evaluating current savings and investments, and determining a timeline for retirement. A well-structured retirement plan ensures that you have the necessary resources to maintain your desired lifestyle after you stop working.

In Brentwood, retirement planning is not just about accumulating wealth but also about managing it effectively. It encompasses various elements such as life insurance, pension plans, and investment strategies tailored to meet your specific goals. Utilizing retirement planning tools and consulting with a financial planner in Brentwood can help you navigate the complexities of planning for retirement.

Why is Retirement Planning Important?

Retirement and financial planning in Brentwood helps you manage risks associated with aging, such as healthcare costs and inflation. It allows you to create a diversified investment portfolio that can provide steady income throughout your retirement years. Additionally, a well-thought-out retirement plan can help you make informed decisions about when to retire, how much to save, and where to invest, aligning with your long-term financial goals.

Factors to Consider When Planning for Retirement in Brentwood

Living Expenses

Estimating your future living expenses is the cornerstone of retirement planning. Consider current costs, including housing, utilities, groceries, and leisure activities, and project how these might change over time. In Brentwood, particular attention should be paid to housing costs, property taxes, and other regional expenses that could affect your budget.

Healthcare and Medical Costs

Healthcare costs can be a significant part of your retirement budget. Planning for these expenses is vital, as they tend to increase with age. Include considerations for Medicare premiums, out-of-pocket expenses, and potential long-term care needs in your plan.

Pension and Social Security

Assess the role of pensions and Social Security benefits in your retirement income. Determine how much you can expect to receive and at what age you can begin to claim these benefits. In Brentwood, knowing the local rules and regulations regarding these benefits can provide clarity and help optimize your income sources.

Current Savings and Investments

Evaluate your current savings, including 401(k) plans, IRAs, and other investment accounts. Analyze your contribution rates and the performance of your investment mix to ensure they align with your retirement goals. Adjustments might be necessary to maximize growth and mitigate risks.

Tax Implications

Understanding the tax implications of your retirement savings and income is important. This includes knowing the tax treatment of withdrawals from retirement accounts, IRA limits, and the benefits of Roth IRAs. Effective retirement tax planning can help minimize your tax burden and maximize your retirement income.

Retirement Timeline

Determine your retirement timeline based on your financial goals and personal preferences. Decide whether you plan to retire early or continue working beyond the traditional retirement age. Your timeline will influence your savings strategy and investment decisions.

Financial Advisors

Consulting with a financial advisor in Brentwood can provide personalized insights and strategies tailored to your unique situation. Advisors can help you navigate complex decisions, optimize your investment portfolio, and develop a robust retirement plan.

Location Considerations

Decide whether you will stay in Brentwood or relocate. Analyze the cost of living, community amenities, and proximity to family and friends in Brentwood compared to other potential retirement locations.

How Much Do You Need to Retire?

To begin calculating your retirement needs, start by estimating your annual living expenses during retirement. This should include housing, healthcare, transportation, food, leisure activities, and any other recurring costs. A common rule of thumb is that you will need about 70% to 80% of your pre-retirement income to maintain your current standard of living. However, personal circumstances, such as travel plans or medical conditions, may require adjustments to this figure.

You need to account for inflation, which erodes the purchasing power of your money over time. Using a retirement planning calculator can help you estimate how much you’ll need, considering inflation and investment returns. For instance, if you anticipate needing $60,000 annually and plan for a 30-year retirement, you may need upwards of $1.8 million, depending on inflation rates and your expected returns on investments.

The First Steps of Retirement Planning

Here’s a guide to get you started:

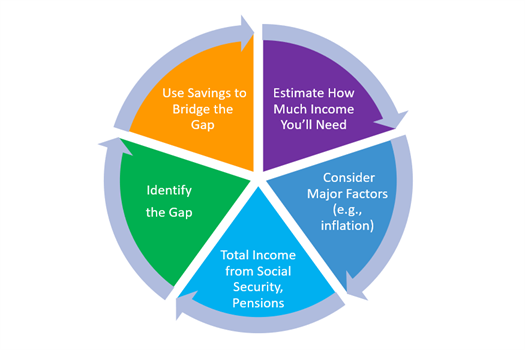

1. Determine Your Retirement Income Needs

Begin by estimating how much income you’ll need annually in retirement. This involves assessing your current expenses and predicting future costs. Consider any changes that retirement may bring, such as reduced commuting expenses or increased travel and healthcare costs.

2. Estimate Your Living Expenses

Calculate your expected living expenses in retirement by reviewing your current spending and projecting future needs. Take into account housing (whether you plan to own or rent), daily living costs, insurance premiums, and potential entertainment and travel expenses. This provides a baseline for your income requirements.

3. Healthcare and Medical Costs

Anticipate higher healthcare costs as you age. This includes not just routine medical care but also potential long-term care needs. Factor in Medicare premiums, co-pays, and out-of-pocket expenses. Brentwood offers various healthcare facilities, but knowing what services you’ll likely use can help refine your estimates.

4. Pension and Social Security

Assess your expected pension and Social Security benefits. These will form a core part of your retirement income. Utilize tools like the Social Security Administration’s calculator to estimate your benefits and determine the best age to start claiming them.

5. Calculate the Gap

Once you have estimated your income needs and expected benefits, calculate the gap between your anticipated expenses and guaranteed income. This gap will need to be filled with withdrawals from savings and investments.

Transitioning to a more detailed analysis, we need to evaluate your current savings and investments to ensure they align with your retirement goals.

Evaluate Your Current Savings and Investments

Taking Stock of Retirement Savings

Begin by reviewing your retirement accounts, such as 401(k)s, IRAs, and other savings plans. Note the balances in each account and the types of investments they hold. This will give you a clear picture of your current financial standing.

Analyze Contribution Rates

Evaluate your contribution rates to retirement accounts. Are you maximizing contributions to your 401(k), especially if your employer offers a matching contribution? Similarly, check if you are contributing the maximum allowable amounts to your Traditional or Roth IRAs.

Investment Mix and Performance Review

Assess the performance of your investments. Diversification is key to reducing risk, so ensure your portfolio includes a balanced mix of stocks, bonds, and other assets. Review how well your investments have performed against benchmarks and whether they align with your risk tolerance and retirement timeline.

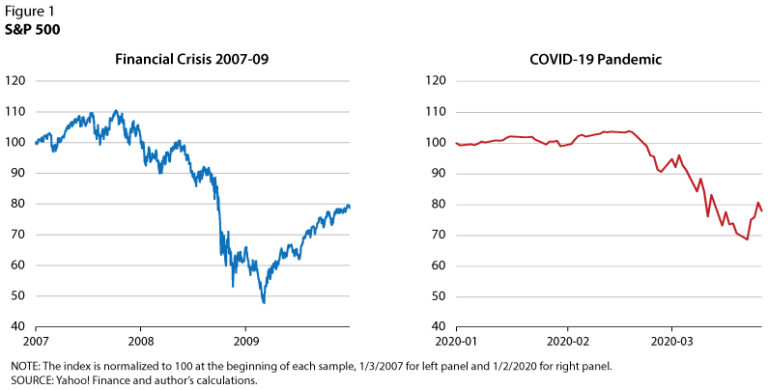

Determine Your Retirement Timeline

Your retirement timeline affects how aggressively you should invest. The closer you are to retirement, the more conservative your investments should become to protect your savings from market volatility. Conversely, if you have a longer timeline, you may be able to take more risks for potentially higher returns.

Understand Tax Implications

Consider the tax implications of your current savings. Withdrawals from Traditional IRAs and 401(k)s are taxed as ordinary income, while Roth IRAs offer tax-free withdrawals under certain conditions. Understanding these implications helps you plan withdrawals efficiently to minimize tax burdens.

Consult with a Financial Advisor

A financial advisor in Brentwood can provide expert guidance tailored to your individual circumstances. They can help you refine your savings strategy, adjust your investment portfolio, and navigate the complexities of tax and withdrawal strategies.

Assess Additional Savings and Investments

Beyond retirement accounts, consider other savings and investments, such as brokerage accounts, real estate, and life insurance. These can provide additional income streams or serve as valuable assets in your overall retirement strategy.

With a clear understanding of your current financial status, you can make informed decisions about adjustments needed to meet your retirement goals. Next, let’s explore the considerations involved in deciding whether to stay in Brentwood or relocate during your retirement.

Explore Relocating vs. Staying in Brentwood for Retirement

Here’s what you need to consider:

Cost of Living in Brentwood

Brentwood offers a high standard of living with quality amenities, healthcare facilities, and community activities. However, the cost of living is relatively high compared to national averages. Housing costs, property taxes, and general expenses can consume a significant portion of your retirement budget. It’s important to assess whether your retirement savings can comfortably support the lifestyle you desire in Brentwood. Consider consulting a retirement planning calculator to compare Brentwood’s costs with other potential retirement locations.

Comparing Other Locations

If you’re considering relocating, evaluate other areas based on cost of living, climate, proximity to family, and availability of healthcare services. Some retirees choose states with no income tax, lower property taxes, or more affordable housing. For instance, relocating to a state with lower living costs might allow you to stretch your retirement savings further, enabling more discretionary spending or travel. Use retirement planning tools to compare expenses and potential savings in different locales.

Community and Family

Proximity to family and friends is a significant factor for many retirees. Staying in Brentwood allows you to remain close to your existing social network and community. If you have strong ties to local clubs, churches, or volunteer organizations, staying put can provide a sense of continuity and belonging. On the other hand, relocating to be closer to children or grandchildren might enhance your family relationships and support network during retirement.

State-Specific Considerations

Each state has unique benefits and challenges for retirees. Tennessee, for example, does not have a state income tax on wages, which can be advantageous for retirees drawing income from pensions or investment returns. Consider other state-specific factors like healthcare quality, senior services, and recreational opportunities. Evaluate how these elements align with your retirement lifestyle preferences.

Plan Your Retirement with Confidence to Expert Retirement Planning Services in Brentwood

Professional Guidance

Engaging with expert retirement planning services in Brentwood, such as Retirement Renegade, can provide tailored advice and strategies to meet your retirement goals. Their professional planners offer comprehensive assessments, personalized financial strategies, and ongoing support to navigate complex retirement decisions. They can help you understand your financial picture, optimize your investment mix, and develop a robust plan to secure your future.

Educational Resources

Access to reliable educational resources can empower you to make informed decisions. Retirement Renegade provides information about wealth management in Brentwood, including guides on retirement planning, tax implications, and investment strategies. Utilizing these resources helps you stay updated on best practices and emerging trends in retirement planning.

Personalized Recommendations

Personalized financial recommendations are important for effective retirement planning. Retirement Renegade offers customized plans that consider your specific needs, goals, and financial situation. They can help you determine the best withdrawal strategies, optimize your tax situation, and ensure your investments are aligned with your retirement objectives.

The Use of Technology

Modern retirement planning tools and software can streamline your planning efforts. These tools enable you to model different retirement scenarios, track your progress, and adjust your strategy as needed. Using technology, in conjunction with professional advice, ensures a comprehensive approach to your retirement planning.

With expert guidance and access to educational resources, you can approach retirement planning with the confidence that you’re making well-informed decisions tailored to your unique circumstances.

Conclusion

Retirement planning in Brentwood, Tennessee, requires a thoughtful approach that balances financial considerations, lifestyle preferences, and personal goals. By understanding how much you need to retire, taking the initial steps to develop a solid plan, evaluating your current savings and investments, and deciding whether to stay in Brentwood or relocate, you can create a comprehensive strategy for a secure and fulfilling retirement.

Engaging with professional retirement planning services, such as those offered by Retirement Renegade, can further enhance your planning efforts, providing you with the tools and guidance needed to navigate the complexities of retirement. Armed with this knowledge and support, you can look forward to a comfortable and enjoyable retirement in Brentwood or wherever your plans may take you.

Frequently Asked Questions about Retirement Planning

What are the first steps of retirement planning?

The first steps of retirement planning involve setting clear retirement goals and assessing your financial situation. Start by estimating your retirement income needs, including living expenses, healthcare costs, and lifestyle choices. Evaluate your current savings and investments to understand where you stand financially. Establish a timeline for your retirement, which will guide your savings and investment strategies. Using tools like retirement calculators can help you project future needs. Finally, consider consulting a financial advisor to create a comprehensive plan tailored to your unique circumstances.

How to retire early?

Retiring early requires meticulous planning and disciplined saving. Begin by setting a specific target retirement age and calculating the amount you need to save to achieve it. Increase your savings rate by contributing the maximum to retirement accounts like 401(k)s and IRAs. Invest in a diversified portfolio to grow your savings, considering a mix of stocks, bonds, and other assets. Minimize debt and reduce unnecessary expenses to free up more money for savings. Monitor your progress regularly and adjust your plan as needed to stay on track. Consulting a financial advisor can provide personalized strategies to help you retire early.

Three reasons to take Social Security early?

Taking Social Security early, typically at age 62, can be beneficial in certain situations. First, if you have health issues or a reduced life expectancy, starting benefits early might maximize your lifetime income. Second, if you need immediate income due to job loss or other financial pressures, early benefits can provide essential support. Third, if you are the lower-earning spouse and can allow the higher-earning spouse to delay their benefits, it can enhance the overall benefits received as a couple. However, it's important to weigh these benefits against the potential reduction in monthly payments for taking early benefits.

What is a conservative rate of return during retirement?

A conservative rate of return during retirement typically ranges from 3% to 5% annually, depending on your risk tolerance and investment strategy. This rate is lower than the average historical return of the stock market to account for reduced risk exposure as you transition to a more conservative investment portfolio. This conservative approach helps preserve your capital and provide stable income, reducing the impact of market volatility on your retirement funds.

How to use life insurance in your retirement planning?

Life insurance can play a vital role in retirement planning by providing financial security and complementing your savings strategy. Permanent life insurance policies, such as whole or universal life, build cash value over time, which you can borrow against or withdraw in retirement. This cash value can serve as a supplemental income source or cover unexpected expenses. Additionally, life insurance can help protect your loved ones from financial burdens, ensuring that they are provided for in the event of your passing. Incorporating life insurance into your plan can also offer tax advantages and estate planning benefits.

What rate of return should I use for retirement planning?

When planning for retirement, using a realistic rate of return is important. For long-term projections, a moderate rate of return of about 6% to 8% annually can be appropriate, reflecting a balanced investment strategy. This rate accounts for a mix of growth-oriented assets like stocks and more stable investments like bonds. However, as you approach retirement and shift to a more conservative portfolio, lowering your expected rate of return to 3% to 5% helps manage risks and reflects the reduced volatility of your investments.

Why is it important to start making retirement plans early in life?

Starting retirement plans early in life provides a significant advantage due to the power of compound interest. The earlier you begin saving, the more time your money has to grow, leading to larger retirement savings. Early planning also allows for more flexible and less aggressive saving strategies, reducing the financial strain later in life. Additionally, it provides a longer horizon to recover from market downturns and adjust your investment strategy. Early planning helps inculcate disciplined saving habits and ensures you can meet long-term financial goals without compromising your current lifestyle.

Why is investing a better option than saving when it comes to planning for retirement?

Investing is generally a better option than saving when planning for retirement because it offers the potential for higher returns. While saving in traditional accounts like savings or certificates of deposit (CDs) provides safety and liquidity, these typically offer lower interest rates that may not keep pace with inflation. Investing in a diversified portfolio of stocks, bonds, and other assets can generate growth that outpaces inflation, increasing your retirement savings over time. Investing also allows for compounding returns, where earnings generate further earnings, enhancing your wealth accumulation potential.

How much money do you need to retire?

The amount of money you need to retire depends on various factors, including your desired retirement lifestyle, expected expenses, and how long you plan to be retired. A common guideline suggests aiming to replace 70% to 80% of your pre-retirement income. To calculate this, estimate your annual retirement expenses and multiply by the number of years you expect to be retired. For example, if you need $60,000 per year and plan to be retired for 30 years, you may need around $1.8 million, adjusted for inflation and investment returns. Using retirement calculators can help refine this estimate based on your specific circumstances.

How to start planning for retirement?

To start planning for retirement, first set clear financial goals by estimating how much income you'll need annually. Assess your current financial situation, including savings, investments, and debts. Open and contribute regularly to retirement accounts like 401(k)s or IRAs. Develop a savings strategy based on your target retirement age and expected expenses. Create a diversified investment plan to grow your savings over time, adjusting it according to your risk tolerance and retirement timeline. Regularly review and adjust your plan as your financial situation changes. Consulting a financial advisor can provide personalized guidance and help ensure you're on track.

Why is financial planning for retirement critically important in Brentwood?

Financial planning in Brentwood for retirement is critically important because it provides a roadmap to ensure you have sufficient resources to maintain your lifestyle after you stop working. It helps you set realistic savings goals, manage investments, and prepare for future expenses, including healthcare and potential long-term care needs. Proper planning also helps mitigate risks, such as market volatility and inflation, and maximizes your income streams, including pensions and Social Security. Without a well-structured plan, you may face financial uncertainty, reduced quality of life, or the need to continue working longer than desired.

How to account for inflation in retirement planning?

To account for inflation in retirement planning, incorporate an estimated annual inflation rate into your projections for expenses and income needs. A common approach is to assume a long-term average inflation rate of 2% to 3% per year. Adjust your savings targets and investment returns accordingly to ensure your retirement funds maintain their purchasing power over time. Use retirement planning tools that include inflation calculators to model different scenarios. Additionally, consider investing in assets that traditionally outpace inflation, such as equities, or incorporating inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) into your portfolio.

How is retirement planning different for young adults today from past generations?

Retirement planning for young adults today differs significantly from past generations due to changes in the job market, increased life expectancy, and shifts in pension availability. Unlike previous generations, many young adults today do not have access to employer-sponsored pensions, requiring them to rely more on personal savings and defined contribution plans like 401(k)s. The gig economy and less predictable career paths also make consistent retirement saving challenging. Additionally, young adults face higher education costs and potential student debt, impacting their ability to save. Modern retirement planning must adapt to these realities with flexible, diversified strategies and early, disciplined saving habits.

When should you begin retirement planning?

You should begin retirement planning as early as possible, ideally in your 20s or when you start your first job. Early planning leverages the power of compound interest, allowing your savings to grow more significantly over time. Starting early also provides more flexibility in adjusting your savings and investment strategies as your career progresses and financial situation evolves. Even if you start later in life, it’s important to begin immediately, as every contribution helps build your retirement fund and reduce the burden on future savings.

Who to talk to about retirement planning?

When planning for retirement, it's beneficial to talk to a financial advisor who specializes in retirement planning. Financial advisors can provide personalized advice based on your unique financial situation, goals, and risk tolerance. They can help you create a comprehensive plan, optimize your investment strategy, and navigate complex issues like taxes and Social Security. Additionally, consider consulting tax professionals for specific tax-related questions and estate planners for advice on how to manage and distribute your assets.

What inflation rate should I use for retirement planning?

For retirement planning, it's prudent to use a long-term average inflation rate of about 2% to 3% per year. This rate reflects historical inflation trends and helps ensure your savings maintain their purchasing power over time. However, keep in mind that actual inflation can vary, so periodically review and adjust your plan to account for changes in the economic environment.

What is the #1 reported mistake related to planning for retirement?

The #1 reported mistake related to planning for retirement is underestimating healthcare costs. Many retirees fail to adequately plan for the rising cost of medical care, which can significantly impact their savings. This includes underestimating premiums, out-of-pocket expenses, and potential long-term care needs. To avoid this mistake, include detailed healthcare cost projections in your retirement plan and consider options like long-term care insurance to mitigate unexpected medical expenses.

Why is Retirement Planning Important?

Why is Retirement Planning Important? How Much Do You Need to Retire?

How Much Do You Need to Retire? The First Steps of Retirement Planning in Franklin

The First Steps of Retirement Planning in Franklin Evaluate Your Current Savings and Investments

Evaluate Your Current Savings and Investments Planning your retirement can be complex, but you don’t have to do it alone. Investing in expert retirement planning services can provide you with the guidance and confidence needed to secure your financial future in Franklin.

Planning your retirement can be complex, but you don’t have to do it alone. Investing in expert retirement planning services can provide you with the guidance and confidence needed to secure your financial future in Franklin.

What is Retirement Planning?

What is Retirement Planning? Evaluate Your Current Savings and Investments

Evaluate Your Current Savings and Investments

Find a Financial Advisor or Resources to Help

Find a Financial Advisor or Resources to Help